Attention: You are about to access Frugal Crest Bank secure page.

Home Equity Lines of Credit

Home Equity Lines of Credit

A Home Equity Line of Credit (HELOC) is a convenient and cost-efficient way to borrow money for almost any purpose. You’ll get the flexibility to pay down your credit line and access funds as you need them.

USE A HELOC TO HELP PAY FOR

- Home improvement

- Unexpected expenses

- Debt consolidation

- Medical expenses

- Vacations

- And, much more!

SAVINGS

Save for life's big moments…

SAVINGS

Save for life's big moments…

And, everything in between. Whether it’s your child’s first savings account or you saving for a rainy day, we can help.

CREDIT CARDS

Give yourself some credit

CREDIT CARDS

Give yourself some credit

Whether you’re building your credit or looking for convenience, we’ve got something that can come in handy. For a secure and easy way to pay, check out our credit card options.

SMALL BUSINESS LENDING

Give your business possibilities

SMALL BUSINESS LENDING

Give your business possibilities

You have ideas and you need to make them happen. We get that. We’re happy to offer the lending tools you need to help your business start, run, grow and flourish.

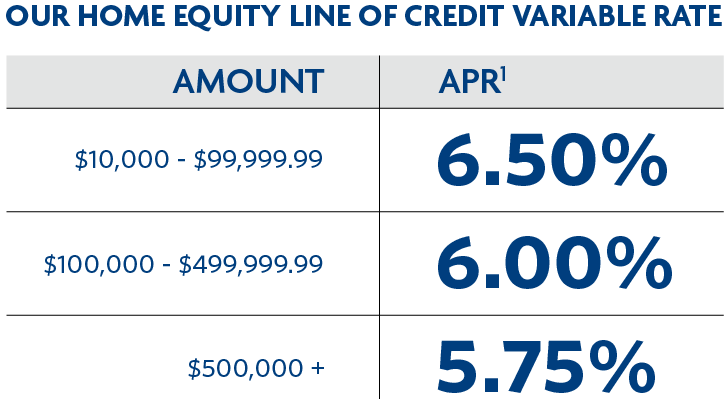

1. The Annual Percentage Rates (APRs) are accurate as of 1/21/19. The total term of the Home Equity Line of Credit (HELOC) is 240 months. During the first 10 years, the “Draw Period”, the APR is a variable rate based on an index of the highest Prime Rate reported in the Money Rates section of the Wall Street Journal (the “WSJ Prime”), plus a margin based on the amount of the line. On 1/21/19, the WSJ Prime Rate was 5.50% resulting in the following APRs: $10,000.00 - $99,999.99: 6.50% (Prime+1.00%), $100,000.00 - $249,999.99: 6.00% (Prime+.50%), $250,000.00 - $499,999.99: 6.00% (Prime + .50%), $500,000 + : 5.75% (Prime + .25). The APR may vary based on the use of auto-debit. Auto-debit discount will not apply when APR is at floor rate or during “Repayment Period.” The minimum APR is 3.99% and the maximum APR is 20.00%. Rates will change on the 1st day of the statement cycle following a Prime Rate change. Interest only minimum payments required during the Draw Period. During the “Repayment Period”, the remaining 10 years, the APR is a variable rate based on the WSJ Prime + 1.00% and will be calculated 45 days prior to the initial maturity of the Draw Period, subsequent changes will occur on the 1st day of the statement cycle following a Prime Rate change. The minimum APR is 3.99% and the maximum APR is 20.00%. During the Repayment Period, monthly principal and interest payments will be required to fully amortize the loan. There is an annual fee of $50, but will be waived for the first year. Offer applies to lines secured by owner occupied, one-to four-family residences with a maximum of 80% Loan to Value (LTV). Offer is not available for purchase money loans. Property insurance required and flood insurance may be required. Consult a tax advisor regarding the deductibility of interest. An early termination fee of the lesser of 2% of the initial credit limit or $500.00 will be charged if account is closed within 24 months of the loan date. No early termination fee in Wisconsin. There may be certain third party fees for entities such as appraisers, credit reporting firms, and government agencies to open the account, which generally total between $0.00 and $1,500.00. Pricing shown assumes borrower meets underwriting guidelines, otherwise a higher APR may apply or credit may not be available. See your loan officer for details. 1/2019.